2018 annual results

2018 annual results

Strong acceleration in orchestrated hybrid cloud

Integration of Syntel and SIX Payment Services moving fast

Revenue at € 12,258 million

+4.2% at constant exchange rates

+1.2% organically with Q4 at +1.2% organically

Operating margin at € 1,260 million

10.3% of revenue

Free cash flow at € 720 million, 57.1% of operating margin

(excluding € 62 million of acquisition and upfront financing costs for Syntel and SIX Payment Services)

Net income Group share at € 630 million

Normalized diluted EPS at 8.56 €

All objectives for 2019 as communicated in October 2018 are confirmed

Project to distribute to Atos’ shareholders 23.4% of Worldline’s share capital

Paris, February 21, 2019

Atos, a global leader in digital transformation, today announces its FY 2018 results.

Thierry Breton, Chairman and CEO, said: “2018 has been a very important year for Atos as the Group significantly strengthened its global profile and capabilities, most notably through two transforming acquisitions: Syntel in digital services, and SIX Payment Services in electronic payments.

During an Investor Day held on January 30, Atos launched ADVANCE 2021, a new 3-year plan designed to build on its reinforced position as a global digital services company and aimed at strengthening its customer centricity through a reinforced vertical go-to-market approach. As part of this plan, Atos also announced its project to distribute 23.4% of Worldline’s share capital to Atos shareholders and to create two listed pure play global leaders with increased strategic and financial flexibility.

Thanks to this plan, I am confident that Atos will create substantial value for all of its stakeholders over the next three years with a revenue organic growth CAGR between +3% and +4%, a profitability at circa 13% in 2021 and a free cash flow reaching 1.2 to 1.3 billion of euros[*].”

Revenue was € 12,258 million, +4.2% at constant exchange rates, and +1.2% organically, particularly led by the Atos Digital Transformation Factory which represented 30% of 2018 revenue (vs. 23% in 2017) benefitting from the strong demand of large organizations implementing their digital transformation.

Operating margin was € 1,260 million, representing 10.3% of revenue, compared to 10.8% in 2017 at constant scope and exchange rates. In 2018, the Group did not record one off related to pension schemes optimization plan in operating margin while in 2017 it had a positive effect of € 28 million representing 20 basis points on operating margin.

The commercial dynamism of the Group was particularly high in 2018 with order entry reaching € 13.7 billion, representing a book to bill ratio of 112% in 2018 compared to 109% in 2017 at constant rate. During the fourth quarter, the book to bill reached 124%.

Net income was € 703 million, +5.8% compared to 2017 and net income Group share reached € 630 million, +5.0% compared to 2017. Therefore, basic and diluted EPS reached respectively € 5.95 (€ 5.72 in 2017) and € 5.95 (€ 5.70 in 2017). Normalized basic and diluted EPS reached respectively € 8.56 (€ 8.24 in 2017) and € 8.56 (€ 8.21 in 2017).

Free cash flow reached € 720 million in 2018, excluding 62 million of acquisition costs on Syntel and SIX Payment Services and upfront financing fees on Syntel, representing a cash conversion of 57.1%.

Net debt was –€ 2.9 billion at the end of 2018 reflecting the amount paid for the acquisition of Syntel during the year, the cash component and the contingent consideration related to the acquisition of SIX Payment Services.

2019 objectives (Atos including Worldline)

In 2019, the Group targets the following objectives for its 3 key financial criteria in line with the target communicated on October 23, 2018 at the time of its Q3 release:

- Revenue organic growth: +2% to +3%

- Operating margin: 11.5% to 12% of revenue

- Free cash flow: € 0.9 billion to € 1.0 billion

Project to distribute 23.4% of Worldline’s share capital to Atos’ shareholders

At the Annual Shareholders Meeting to be held on April 30, 2019, a resolution related to the distribution to Atos’ shareholders of 23.4% of Worldline’s share capital will be submitted to Atos’ shareholders.

As a reminder, on January 29, 2019, Atos’ Board of Directors, following a specific governance process, proposed to submit to its shareholders the project to distribute in kind around 23.4% of Worldline’s share capital, out of the 50.8% currently owned by the Group. Post transaction, Atos would retain approximately 27.4% of Worldline’s share capital and Worldline’s free float would be increased to approximately 45.7%. Atos will remain the first shareholder and the shareholders agreement between Atos and SIX will be amended to reflect the continued partnership between the two groups post distribution, and both parties are expected to commit to a 6-month joint lock-up on their respective stakes in Worldline.

The distribution is expected to take place during the first half of May 2019.

Following the partial distribution, Worldline is expected to be deconsolidated from the Group’s accounts and Atos remaining stake booked as “investment in associates accounted for under the equity method”.

2019 objectives in digital services (Atos excluding Worldline)

In its digital services activities, Atos aims to deliver in 2019 the following objectives for its 3 key financial criteria:

- Revenue organic growth: +1% to +2%

- Operating margin: 10.5% of revenue

- Free cash flow: € 0.6 billion to € 0.7 billion

2018 performance by Division

| Revenue | Operating margin | Operating margin % | |||||

| In € million | 2018 | 2017* | Organic evolution |

2018 | 2017* | 2018 | 2017* |

| Infrastructure & Data Management | 6,328 | 6,513 | -2.8% | 604 | 730 | 9.5% | 11.2% |

| Business & Platform Solutions | 3,361 | 3,227 | 4.2% | 300 | 283 | 8.9% | 8.8% |

| Big Data & Cybersecurity | 895 | 799 | 12.0% | 138 | 104 | 15.4% | 13.0% |

| Corporate costs | – | – | – 74 | – 72 | -0.7% | -0.7% | |

| Worldline | 1,674 | 1,576 | 6.3% | 293 | 263 | 17.5% | 16.7% |

| Total | 12,258 | 12,114 | 1.2% | 1,260 | 1,308 | 10.3% | 10.8% |

| * At constant scope and exchange rates | |||||||

Infrastructure & Data Management: Accelerated transition to hybrid cloud

Revenue was € 6,328 million, down -2.8%. Migration to Hybrid Cloud significantly accelerated during the year and Digital Workplace continued to grow. The Division continued the digital transformation of its main clients through automation and robotization. In 2018, revenue was impacted by two large contracts not renewed in North America, Marriott International and Standard & Poor’s, as well as a contractual issue with a Telco operator in Germany. In the fourth quarter, revenue decreased by -3.4% (Q3 at -4.6%).

Operating margin was € 604 million, representing 9.5% of revenue, decreasing by -170 basis points compared to the last year as a result of the items mentioned above for North America and Germany. These two geographies monitored throughout the year a cost take-out to mitigate the effects on the profitability.

The Division benefited from improved results posted in the United Kingdom and other GBUs.

Business & Platform Solutions: Further top line improvement thanks to digital and automation projects

Revenue reached € 3,361 million, +4.2% at constant scope and exchange rates, confirming a positive trend since the beginning of the year. The growth was led by all the large geographies: United Kingdom & Ireland, Germany, France, and North America. The Division benefited from the dynamic in digital projects and automation in most of the geographies.

Operating margin was € 300 million, representing 8.9% of revenue. Business & Platform Solutions continued to invest in innovation, new Codex and SAP HANA offerings.

Big Data & Cybersecurity: Double digit revenue growth led by a strong demand for Cybersecurity solutions and High Performance Computing

Revenue in Big Data & Cybersecurity was € 895 million, up +12.0% organically, maintaining a strong performance all over the year and pulled by the extension of the Division’s markets, both in terms of industries served and geographies. Cybersecurity strongly grew as customers’ investments increased to prevent from more and more sophisticated cyberattacks. The performance was also driven by the strong sales dynamics in Big Data, sales of Bullions notably in North America, software and products, as well as increased projects in France. Finally, High Performance Computing benefitted from new wins achieved in several geographies.

Operating margin was € 138 million significantly improved by +240 bps compared to 2017 on a like for like basis and representing 15.4% of revenue. This solid performance resulted from strong growth contribution and improved cost base monitoring, while pursuing investments in innovative solutions and products, as well as the benefits from the successful integration of CVC activities.

Worldline: Leveraging the full benefits from its undisputed European leadership in payment services

From a contributive perspective to Atos, Worldline revenue was € 1,674 million, improving by +6.3% at constant scope and exchange rates, representing 13.7% of the Group revenue. Growth was led in the three business segments by:

- Merchant Services growing by +4.2% organically and reaching € 621 million. The growth mainly came from increased transactions volumes, notably through a strong momentum in India and from positive business trends in Continental Europe;

- Financial Processing reached € 773 million, up +7.6% organically thanks to increased volumes, in Sepa payment transactions, strong growth in Acquiring Processing as well as in Issuing Processing in internet payments;

- Mobility & e-Transactional Services revenue was € 280 million, up +7.4% organically led by Trusted Digitization, E-Consumer and Mobility growth, combined with higher volumes in Contact and Consumer Cloud activities.

Operating margin was € 293 million or 17.5% of revenue, improving by +80 basis points led by the strong performance of Financial Processing, thanks to revenue and the successful implementation of equensWorldline costs synergies plan. Merchant Services benefitted from transactions volume growth, continued productivity improvement and first results of synergies with MRL Postnet. Finally, Mobility & e-Transactional Services operating margin was impacted by base effect of pensions recorded last year as well as commercial litigations during the first part of the year. A detailed presentation of Worldline 2018 performance is available at worldline.com, in the investors section.

2018 performance by Business Unit

| Revenue | Operating margin | Operating margin % | |||||

| In € million | 2018 | 2017* | Organic evolution |

2018 | 2017* | 2018 | 2017* |

| Germany | 2,161 | 2,158 | 0.1% | 137 | 195 | 6.3% | 9.0% |

| North America | 2,022 | 2,136 | -5.3% | 202 | 268 | 10.0% | 12.5% |

| France | 1,710 | 1,665 | 2.7% | 150 | 159 | 8.8% | 9.6% |

| United Kingdom & Ireland | 1,612 | 1,600 | 0.7% | 193 | 180 | 11.9% | 11.3% |

| Benelux & The Nordics | 1,017 | 1,018 | -0.1% | 76 | 94 | 7.5% | 9.2% |

| Other Business Units | 2,061 | 1,961 | 5.1% | 275 | 228 | 13.4% | 11.6% |

| Global structures** | – | – | – 66 | – 79 | -0.6% | -0.8% | |

| Worldline | 1,674 | 1,576 | 6.3% | 293 | 263 | 17.5% | 16.7% |

| Total | 12,258 | 12,114 | 1.2% | 1,260 | 1,308 | 10.3% | 10.8% |

| * At constant scope and exchange rates | |||||||

| ** Global structures include the IT Services Divisions global costs not allocated to the Business Units and Corporate costs. Worldline holds | |||||||

| its own corporate costs | |||||||

In 2018, all the geographies were either growing or stable, except North America as mentioned above due to the activity impacted by two large contracts not renewed.

Operating margin remained double-digit at 10.3% compared to 10.8% in 2017 (10.6% excluded one off pension). Due to the reasons mentioned above in revenue for both North America and Germany, despite the costs monitoring in the two countries operating margin decreased in these two Global Business Units. However, North America achieved to reach 10.0% operating margin. United Kingdom & Ireland succeeded in improving its operating profitability at 11.9%. Finally, Worldline reached all its targets in 2018 with revenue organic growth at 6.3% and operating margin at 17.5%.

Commercial activity

The commercial dynamism of the Group was particularly high in 2018 with order entry reaching € 13.7 billion, representing a book to bill ratio of 112% in 2018 compared to 109% in 2017 at constant rate. During the fourth quarter, the book to bill reached 124%. Full backlog increased to € 24.5 billion from € 22.7 billion at the end of 2017, representing almost 1.8 years of revenue. The full qualified pipeline reached € 8.1 billion compared to € 7.4 billion published at the end of 2017.

Operating income and net income

Operating income reached € 836 million in 2018, -4.4% compared to 2017, resulting from the following items:

Costs for staff reorganization, rationalization, and integration amounted to €-201 million, including acquisition and integration costs related to the acquisitions of Syntel and SIX Payment Services as well as integration costs for EquensWorldline for a total of € 52 million. Therefore, excluding those exceptional items, costs for staff reorganization, rationalization, and integration are at the level of 2017, excluding € 15 million of integration costs for EquensWorldline.

Amortization of Purchase Price Allocation of acquired companies represented €-128 million compared to €-109 million in 2017. The increase mainly came from 2 months of amortization related to the acquisition of Syntel (€ 11 million) and 1 month of amortization related to the acquisition of SIX Payment Services (€ 4 million). The amortization of the equity based compensation plans amounted to €-52 million, compared to €-86 million in 2017, resulting from a lower performance in 2018 compared to 2018 objectives announced on February 23, 2018.

Other items amounted to €-43 million compared to €- 59 million in 2017 where occurred exceptional expenses related to cyberattacks, the implementation of GDPR and settlement of litigations. The € 43 million expenses in 2018 corresponded mainly to semi-retirement schemes in Germany and France.

Net financial result was a charge of €-87 million, compared to €-62 million in 2017, including the cost of pensions, the interest on bonds issued in June 2015 and in October 2016 as well as the new financing structure due to Syntel acquisition (€ 1.8 billion triple tranche bond issued in November 2018 and $ 1.9 billion 3 and 5 year term loan signed in October 2018 and drawn in US dollars and in Euros) and the change in the fair value of SIX Payment Services contingent consideration for € -18 million.

Total tax charge was €-47 million. Excluding the recognition of deferred tax asset in France for € 90 million, tax charge was € -137 million representing an effective tax rate of 18.3%, stable compared to 2017.

As a result, net income was € 703 million, +5.8% compared to 2017. Non-controlling interests amounted to € 73 million and were related to the minority shareholders in Worldline. Therefore, the net income Group share reached € 630 million, +5.0% compared to 2017.

Basic EPS Group share was € 5.95, +4.0% compared to 2017 and Basic diluted EPS Group share was € 5.95, +4.4% compared to 2017. Normalized EPS Group share was € 8.56, as well as Normalized diluted EPS Group share also € 8.56, increasing compared to 2017 by +4.3%.

Free cash flow

Operating Margin before Depreciation and Amortization (OMDA) was € 1,601 million representing 13.1% of revenue, compared to 13.4% of restated revenue in 2017.

Reorganization, rationalization and associated costs, and integration and acquisition costs reached € -189 million compared to € -157 million in 2017, significantly impacted by the two transformative acquisitions (Syntel and SIX Payment Services) occurred in 2018 as well as the costs of implementation to generate synergies on equensWorldline for a total amount of € -53 million. Excluding this amount, those costs reached circa 1% of revenue in line with the Group policy.

Capital expenditures amounted to € -476 million, representing as expected 3.9% of revenue compared to € -526 million in 2017 or 4.4% of revenue. The Group continued to invest, especially in its payment platforms within Worldline, as well as in its infrastructure business, in particular in Cloud architectures.

Change in working capital was € -74 million, due to the evolution of the revenue mix and more particularly an increase in Business & Platform Solutions and in Financial Services where the DSO is higher than the average.

The effective DSO reached 43 days compared to 39 days at the end of December 2017 and has been positively impacted by the sale of receivables with no recourse on large customer contracts by 23 days, representing an increase by € 36 million in 2018. During the second semester of 2018, the change in working capital amounted to € +66 million, with no increase of the sales of receivables compared to end of June, reflecting the strong decrease by more than 10% of the amount of contract assets over H2. As a reminder, the Company committed not to increase the sales of receivables without recourse as of 2019.

Cash out related to tax paid reached € -130 million, in line with previous year.

The cost of net debt increased to € -31 million compared to € -24 million in 2017 mainly due to the new financing structure related to the acquisition of Syntel in October 2018.

Finally, other items totaled €-43 million, compared to €-30 million in 2017.

As a result, free cash flow reached € 658 million in 2018 and € 720 million excluding € -62 million of acquisition costs on Syntel and SIX Payment Services and upfront financing fees on Syntel compared to € 714 million in 2017, representing 57.1% of the operating margin.

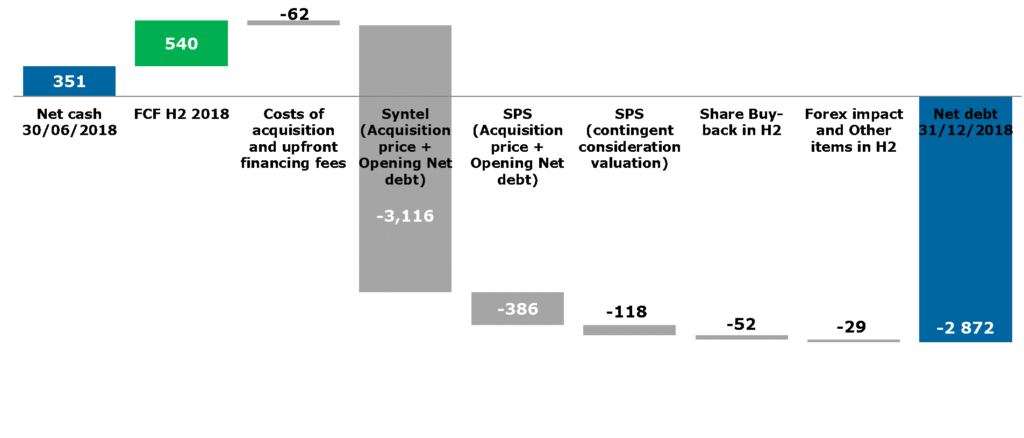

Net cash evolution

Net acquisitions / disposals in 2018 amounted to €-3,644 million, mainly related to the acquisitions of Syntel (net acquisition price of € -3,116 million) and SIX Payment Services (net acquisition price of € -386 million as well as a contingent consideration valuation of € -118 million).

Capital increase, mostly related to proceeds from the employee share plan totaled €+22 million in 2018.

In 2018 the Group performed a share buy-back program for € 102 million to deliver performance shares to beneficiaries.

The cash-out (excluding option in shares) for the payment of dividend on 2017 results was €-79 million.

Finally, mainly due to the euro increase versus the US dollar, foreign exchange rate fluctuation effect on debt or cash in foreign currencies totaled €-34 million.

As a result, Group net debt position as of end of 2018 was € -2,872 million.

Focus on net debt evolution in H2 2018

Human resources

The total headcount was 122,110 at the end of 2018 compared to 97,267 at the end of 2017.

Excluding scope effect from 2018 acquisitions (of which 23,480 from Syntel and 1,344 from SIX Payment Services), this represents a decrease by -2.1% compared to the end of 2017 and translates the Group hiring adaptation along with the implementation of automation and focus on digital transformation skills. The Group pursued the digital training and reskilling of its teams.

Following the integration of Syntel, staff located in offshore and nearshore countries at the end of 2018 represented 41% of Group total headcount.

Dividend

During its meeting held on February 20, 2019, the Board of Directors decided to propose to the next Annual Shareholders Meeting a dividend in 2019 on the 2018 results of € 1.70 per share with the option for each shareholder to receive the dividend in Atos shares. The ordinary dividend would be paid at the end of May 2019.

2021 targets in Digital Services (Atos excluding Worldline)

At the occasion of its Investor Day held in its headquarters in Bezons on January 30, 2019, Atos announced its unaudited FY 2018 results as well as its new 3-year plan, ADVANCE 2021, covering the 2019-2021 period.

In its digital services activities, Atos aims to deliver:

- Revenue organic growth: +2% to +3% CAGR over the 2019-2021 period

- Operating margin rate: 11% to 11.5% of revenue in 2021

- Free cash flow: between € 0.8 billion and € 0.9 billion in 2021

To reach its 2021 ambition, ADVANCE 2021 will focus on 8 levers:

- Complete the transition to Cloud/Hybrid Cloud of its main customers and accelerate the transformation of the IDM business towards the next growth drivers: Smart Data Management, IoT, Ecosystems of Infrastructures, Digital Workplace, Automation, Artificial Intelligence, and Machine Learning;

- Accelerate the Industry specific Digital business transformation of Atos’ customers by successfully integrating Syntel and generate the synergies to reach a profitability level above 13% in Business & Platform Solutions;

- Provide the high-end computing for Big Data algorithms, Cybersecurity and Mission Critical technologies to help customers succeed in the gigantic data era and to sustain a solid double-digit growth over the next three years;

- Delivering the next wave of Digital transformation, increasing the focus on industry verticals and solutions, deepening customer expertise and intimacy pulling through all Atos services and capability;

- RACE: A powerful combination of digital productivity levers and agile collaboration to sustain our compelling value creation;

- Maintain excellence in People skills and CSR;

- Continue to participate in the Digital industry consolidation to expand its customer base and to strengthen its technological capabilities;

- Support Worldline to remain the undisputed European leader in payments.

Regarding its dividend policy, the Group intends to pursue its current policy in line with the pay-out ratio between 25% and 30% of Net income Group share. The result from the distribution of 23.4% share capital of Worldline to Atos’ shareholders will be excluded from the 2019 Net income Group Share on which the 25%-30% payout ratio will be applied to determine the 2020 dividend.

Appendix

Atos consolidated and statutory financial statements for the year ended December 31, 2018, were approved by the Board of Directors on February 20, 2018. Consolidated financial statements have been audited.

2018 Financial Report will be posted on Atos Investor Website on February 21, 2019.

Revenue and operating margin at constant scope and exchange rates reconciliation

| In € million | 2018 | 2017 Restated for IFRS 15 |

% change | 2017 Reported |

% change |

| Statutory revenue | 12,258 | 11,996 | 2.2% | 12,691 | -3.4% |

| Exchange rates effect | -234 | -249 | |||

| Revenue at constant exchange rates | 12,258 | 11,762 | 4.2% | 12,442 | -1.5% |

| Scope effect | 359 | 359 | |||

| Exchange rates effect on acquired/disposed perimeters | -8 | -8 | |||

| Revenue at constant scope and exchange rates | 12,258 | 12,114 | 1.2% | 12,794 | -4.2% |

| Statutory operating margin | 1,260 | 1,292 | -2.5% | 1,292 | -2.5% |

| Scope effect | 52 | 52 | |||

| Exchange rates effect | -37 | -37 | |||

| Operating margin at constant scope and exchange rates | 1,260 | 1,308 | -3.7% | 1,308 | -3.7% |

| as % of revenue | 10.3% | 10.8% | 10.2% |

Scope effects amounted to €+359 million for revenue. This was mostly related to the acquisitions of Syntel (2 months for €+142 million), SIX Payment Services (1 month for €+50 million), and CVC (12 months for €+73 million). Other effects were related to the acquisitions of Healthcare Consulting firms in North America, Imakumo, Air Lynx and payment companies by Worldline on one side, and to the disposal of some specific Unified Communication & Collaboration activities, Cheque Service and Paysquare Belgium on the other side.

Scope effects amounted to €+52 million for operating margin. Most of the impact came from the acquisitions of Syntel (2 months for €+43 million), SIX Payment Services (1 month for €+6 million), and CVC (12 months for €-8 million).

The following internal transfers occurred as of January 1st, 2018: (i) Diamis activities from Business & Platform Solutions in France to Worldline, (ii) activities from Other Business Units to Germany, and (iii) activities in Israel which were consolidated in North America as part of Xerox ITO acquisition to Other Business Units.

IFRS 15 adjustment represented a restatement of FY 2017 accounts of €-695 million for revenue.

Currency exchange rates effects mainly came from the American dollar, the Argentinian peso, the Brazilian real, the Turkish lira and the British pound depreciating versus the Euro and negatively contributed to revenue for €-242 million and to operating margin for €-37 million.

2018 revenue performance by Market

| Revenue | |||

| In € million | 2018 | 2017* | Organic evolution |

| Manufacturing, Retail & Transportation | 4,492 | 4,501 | -0.2% |

| Public & Health | 3,387 | 3,372 | 0.4% |

| Financial Services | 2,449 | 2,313 | 5.9% |

| Telcos, Media & Utilities | 1,930 | 1,928 | 0.1% |

| Total | 12,258 | 12,114 | 1.2% |

| * At constant scope and exchange rates | |||

Q4 2018 revenue performance by Division, Business Unit, and Market

| Revenue | |||

| In € million | Q4 2018 | Q4 2017* | Organic evolution |

| Infrastructure & Data Management | 1,638 | 1,696 | -3.4% |

| Business & Platform Solutions | 977 | 937 | 4.2% |

| Big Data & Cybersecurity | 275 | 249 | 10.5% |

| Worldline | 478 | 447 | 6.9% |

| Total | 3,368 | 3,329 | 1.2% |

| * At constant scope and exchange rates | |||

| Revenue | |||

| In € million | Q4 2018 | Q4 2017* | Organic evolution |

| Germany | 586 | 580 | 1.1% |

| North America | 590 | 636 | -7.2% |

| France | 488 | 469 | 4.1% |

| United Kingdom & Ireland | 404 | 410 | -1.4% |

| Benelux & The Nordics | 265 | 262 | 1.3% |

| Other Business Units | 556 | 525 | 5.9% |

| Worldline | 478 | 447 | 6.9% |

| Total | 3,368 | 3,329 | 1.2% |

| * At constant scope and exchange rates | |||

| Revenue | |||

| In € million | Q4 2018 | Q4 2017* | Organic evolution |

| Manufacturing, Retail & Transportation | 1,257 | 1,224 | 2.7% |

| Public & Health | 874 | 916 | -4.7% |

| Financial Services | 714 | 685 | 4.2% |

| Telcos, Media & Utilities | 524 | 504 | 4.0% |

| Total | 3,368 | 3,329 | 1.2% |

| * At constant scope and exchange rates | |||

Forthcoming events

- April 25, 2019: Q1 2019 revenue

- April 30, 2019: 2018 Annual General Meeting

- July 25, 2019: H1 2019 results

- October 24, 2019: Q3 2019 revenue

Contacts

Media:

Terence Zakka – +33 1 73 26 40 76 –terence.zakka@atos.net

Sylvie Raybaud – +33 6 95 91 96 71 – sylvie.raybaud@atos.net

Investor Relations:

Gilles Arditti – +33 1 73 26 00 66 – gilles.arditti@atos.net

About Atos

Atos is a global leader in digital transformation with 120,000 employees in 73 countries and annual revenue of € 13 billion. European number one in Cloud, Cybersecurity and High-Performance Computing, the Group provides end-to-end Orchestrated Hybrid Cloud, Big Data, Business Applications and Digital Workplace solutions through its Digital Transformation Factory, as well as transactional services through Worldline, the European leader in the payment industry. With its cutting-edge technologies and industry knowledge, Atos supports the digital transformation of its clients across all business sectors. The Group is the Worldwide Information Technology Partner for the Olympic & Paralympic Games and operates under the brands Atos, Atos Syntel, Unify and Worldline. Atos is listed on the CAC40 Paris stock index.

For more information, visit: atos.net.

Disclaimers

This document contains forward-looking statements that involve risks and uncertainties, including references, concerning the Group’s expected growth and profitability in the future which may significantly impact the expected performance indicated in the forward-looking statements. These risks and uncertainties are linked to factors out of the control of the Company and not precisely estimated, such as market conditions or competitors behaviors. Any forward-looking statements made in this document are statements about Atos’ beliefs and expectations and should be evaluated as such. Forward-looking statements include statements that may relate to Atos’ plans, objectives, strategies, goals, future events, future revenues or synergies, or performance, and other information that is not historical information. Actual events or results may differ from those described in this document due to a number of risks and uncertainties that are described within the 2017 Registration Document filed with the Autorité des Marchés Financiers (AMF) on February 26, 2018 under the registration number: D.18-0074 and its update filed with the Autorité des Marchés Financiers (AMF) on July 27, 2018 under the registration number: D.18-0074-A01.

Revenue organic growth is presented at constant scope and exchange rates, and restated for the impact of IFRS 15. Operating margin is presented as defined in the 2017 Registration Document. Starting January 1st, 2018, dividends paid to non-controlling interests are not anymore a Free Cash Flow item but reported in line ‘Dividends paid’. Further to IFRS 16 implementation as of January 1st, 2019, lease liabilities will be recognized into Group balance sheet. Lease liabilities will be excluded from the Group net debt definition. Therefore, Free Cash Flow as per Group definition will remain comparable with prior years.

Business Units include Germany, North America (USA, Canada, and Mexico), France, United Kingdom & Ireland, Worldline, Benelux & The Nordics (Belgium, Denmark, Estonia, Finland, Lithuania, Luxembourg, The Netherlands, Poland, Russia, and Sweden), and Other Business Units including Central & Eastern Europe (Austria, Bulgaria, Croatia, Czech Republic, Greece, Hungary, Israel, Italy, Romania, Serbia, Slovakia and Switzerland), Iberia (Spain and Portugal), Asia-Pacific (Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, Taiwan, and Thailand), South America (Argentina, Brazil, Colombia, and Uruguay), Middle East & Africa (Algeria, Benin, Burkina Faso, Egypt, Gabon, Ivory Coast, Kingdom of Saudi Arabia, Lebanon, Madagascar, Mali, Mauritius, Morocco, Qatar, Senegal, South Africa, Tunisia, Turkey and UAE), Major Events, Global Cloud hub, and Global Delivery Centers.

Atos does not undertake, and specifically disclaims, any obligation or responsibility to update or amend any of the information above except as otherwise required by law.

This document does not contain or constitute an offer of Atos or Worldline’s shares for sale or an invitation or inducement to invest in Atos or Worldline’s shares in France, the United States of America or any other jurisdiction.

[*] including Worldline