First half 2018 results

Confirmation of a strong commercial dynamic

Revenue at € 6,005 million,

+3.4% at constant exchange rates, +1.7% organically

Order entry at € 7,051 million, book-to-bill ratio at 117%

Operating margin at € 545 million, 9.1% of revenue

Free cash flow at € 180 million

Atos to acquire Syntel to enhance its digital business, strengthen its leading position in Business & Platform Solutions, and significantly accelerate its development in North America

All 2018 objectives confirmed

Bezons, July 23, 2018. Atos, a global leader in digital transformation, today announces its financial results for the first half of 2018.

Thierry Breton, Chairman and CEO said: “During the first half of the year we confirmed a strong commercial dynamic consolidating our strategy to accompany our customers all along their digital transformation. By leveraging the strengths of all our Divisions in our Digital Transformation Factory, we signed very large transformation contracts translating in a strong book to bill ratio in each Division and 117% for the Group. The commercial activity was particularly high in North America in Q2 with a book to bill ratio at 190%. In the meantime we continued to closely monitor our operational efficiency, improving the Group profitability and increasing EPS by circa 8 %. In this context, we confirm all our objectives for 2018 towards our 2019 Ambition.

After the transformational acquisition of SIX Payment Services by Worldline to be closed this year-end, I am proud with the announcement of another strategic move for the Group with the project to acquire Syntel, a US leading company in digital services, listed on Nasdaq. It represents a major step in Business & Platform Solutions as it will significantly enhance the Division growth and profitability profile through an extended digital services offering, cutting-edge India based delivery platforms, as well as revenue and cost synergies.

The highly complementary portfolio, customer basis, and geographical presence of the combination between Atos and Syntel will significantly enhance our footprint, in particular in the North American market and accelerate the digital transformation of Atos’ customers.

All these strategic achievements make me fully confident in the strong potential of our Group to continue delivering together with Syntel and SIX Payment employees and their very strong management highest value to our clients and shareholders. I am looking forward to welcoming all of them.”

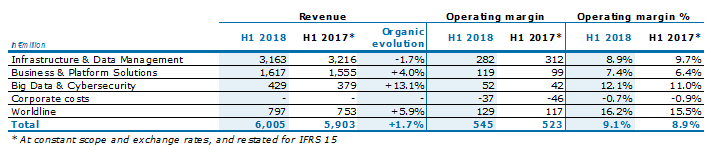

H1 2018 performance by Division

Revenue was € 6,005 million, up +3.4% at constant exchange rates restated from IFRS 15 and +1.7% organically, deriving from the demand of large organizations implementing their digital transformation. This particularly benefitted to Business & Platform Solutions, Big Data & Cybersecurity, and Worldline. The Group grew by +2.8% excluding North America which is expected to go back to growth by year-end. Operating margin was € 545 million, representing 9.1% of revenue.

In Infrastructure & Data Management (IDM) revenue was € 3,163 million, -1.7% organically. The decrease of the Division was due to the specific management issue in North America. In line with the transformation of the business model of the Division, revenue significantly grew in Orchestrated Hybrid Cloud, in Digital Workplace and in projects in Technology Transformation Services. The Division continued the digital transformation of its main clients through automation and robotization, supporting growth in several geographies, notably France, the United Kingdom, Iberia, Asia Pacific, and Middle-East & Africa.

Operating margin was € 282 million, representing 8.9% of revenue. Profitability improved in France, the United Kingdom and “Other Business Units”. Nevertheless, IDM margin was mainly impacted by lower revenue in North America where two thirds were compensated by strong actions on the cost base, and to a lesser extent in Germany.

Business & Platform Solutions (B&PS) revenue was € 1,617 million, up +4.0% at constant scope and exchange rates. The Division pursued the solid trend recorded since the beginning of the year in most of the geographies, fueled by an increasing demand for digital projects, mainly related to SAP HANA, Codex, and Hybrid Cloud solutions. The sales dynamic was visible in most of the markets.

Operating margin was € 119 million, representing 7.4% of revenue. Business & Platform Solutions continued its positive trend of profitability improvement with +100 basis points in H1 2018, mainly led by the good revenue performance and a better business mix in revenue coming from digital offerings.

Revenue in Big Data & Cybersecurity (BDS) showed a high organic growth of +13.1%, leading to € 429 million in the first half of 2018. This strong performance was primarily recorded in the United Kingdom, North America and Germany. Growth was driven by very dynamic Cybersecurity activities in the large geographies, as well as sales of Bullions mainly in North America and in France. High Performance Computing recorded a strong growth in Germany driven by significant activities with research institutes, and new opportunities were generated in several geographies such as France.

Operating margin was € 52 million, representing 12.1% of revenue and a strong improvement of +110 basis points. The Division continued to record significant growth while investing in innovative solutions and products as well as extending its international footprint. It also started to benefit from the integration of CVC activities.

From a contributive perspective to Atos, Worldline revenue was € 797 million, growing by +5.9% at constant scope and exchange rates. Merchant Services was up by +4.3% organically, led primarily by Commercial Acquiring in Continental Europe and a solid double digit growth in India. Financial Processing was up +7.2% with a high level of projects and increased authorization volumes, and thanks to Software licensing revenue benefitting from a newly signed contract. The +5.4% growth in Mobility & e-Transactional Services was mainly led by Trusted Digitization projects with French Government agencies as well as healthcare transactional and tax collection services in Latin America.

Operating margin reached € 129 million or 16.2% of revenue, a +70 basis points improvement led by the strong revenue performance of Financial Processing and the continuous generation of cost synergies on equensWorldline. Merchant Services operating margin also improved thanks to transactions volumes growth and productivity gains in Commercial Acquiring. Finally, Mobility & e-Transactional Services faced the base effect of the € 7 million one-off pension item recorded last year. Excluding the latter effect, Worldline operating margin improved by 160 basis points.

A detailed presentation of Worldline’s performance during the first half 2018 is available at worldline.com, in the investors section.

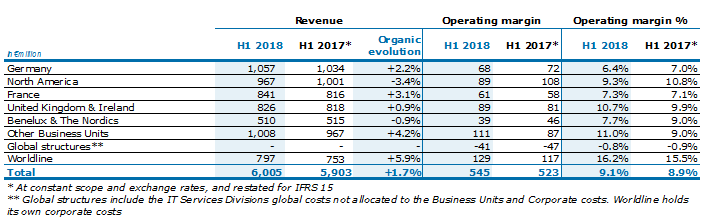

H1 2018 performance by Business Unit

During the first half of 2018, revenue grew in most of the Business Units. In particular, revenue growth in Germany was driven by the ramp-up of new B&PS projects, notably in the public sector, and from additional BDS activity compensating for the base effect of two large IDM Transition & Transformation phases completed last year. In France, growth was fueled by IDM thanks to several contract ramp-ups and B&PS benefitting from new projects in Public Sector and Financial Services. United Kingdom & Ireland grew in a complex environment thanks to the ramp-up of new IDM contracts, notably in Financial Services, which more than offset the partial re-insourcing of the BBC contract. Other Business Units positively contributed to the revenue evolution of all Divisions, mainly thanks to Central & Eastern Europe, Asia-Pacific, Iberia, and South America. Worldline recorded a strong performance in all its businesses as detailed above.

North America achieved a significant growth in B&PS and BDS but this could not compensate IDM. In Q2, the Business Unit succeeded to complete signatures leading to a record level of order entry and a 190% book to bill which should contribute to improve revenue evolution in the next semester. In Benelux & The Nordics, revenue slightly decreased due to the ramp-down of B&PS contracts in Telco while IDM remained stable and BDS confirmed a growing trend.

France, United Kingdom, Worldline, and Other Business Units improved their operating margin thanks to the combination of revenue growth and better revenue mix on added-value services. North America decrease came from revenue erosion although the majority was compensated by adjustments on the cost base. Benelux & The Nordics, on top of revenue evolution, continued to invest in development and presales activities especially in BDS. Globally, the Group reinforced its transformation programs through industrialization, automation and robotization, operational efficiency on project management, and structure cost base optimization.

Commercial activity

During the first semester of 2018, the Group order entry reached € 7,051 million, representing a book to bill ratio of 117% with a particularly strong Q2 at 134%.

H1 book to bill ratios were particularly high in IDM and BDS at 123% and 127% respectively. B&PS recorded a healthy 105% with a solid Q2 at 116%. Finally, Worldline reported 114% with a strong acceleration in Q2.

New contracts in Q2 benefitted to IDM thanks to a strong commercial dynamism in particular in North America with the signature of contracts in Orchestrated Hybrid Cloud and Digital Workplace in Financial Services or for Industry 4.0. Still in IDM, the UK signed a large Robotic Process Automation (RPA) contract in the public sector. Germany signed new large multi-Divisions contracts such as with Siemens or in the aerospace industry. Worldline signed a major partnership contract with Commerzbank in Q2.

Renewals in Q2 included large contracts such as in Public sector in the UK, and in the Oil & Gas industry in both Benelux & The Nordics and North America.

In line with the dynamic commercial activity, the full backlog at the end of June 2018 amounted to € 23.2 billion compared to € 22.2 billion at the end of December 2017, representing 1.9 year of revenue. The full qualified pipeline was € 7.7 billion, compared to € 7.3 billion at the end of December 2017 and representing 7.8 months of revenue.

Operating income and net income

Operating income for the first half of 2018 year was € 342 million, +4.4% year-on-year, resulting from the following items:

Costs for staff reorganization, rationalization, and integration amounted to € 83 million stable compared to in H1 2017, as a consequence of the adaptation of the Group workforce in continental Europe, North America, and the United Kingdom, the related closure of office premises, and data centers consolidation. This amount also came from the current integration of equensWorldline, the integration of several acquisitions performed in 2017 including CVC, and the acquisition costs of the ongoing operation with SIX Payments within Worldline.

The amortization of the equity based compensation plans amounted to €-39 million, compared to €-45 million in the first half of 2017 and in line with the €-41 million recorded in the second half of 2017.

€-57million were recorded as Purchase Price Allocation amortization compared to €-62 million in H1 2017.

Other items amounted to a charge of € -24 million compared to €-22 million corresponding mainly to expenses related to semi-retirement schemes in Germany and France.

Net financial result was a charge of €-21 million compared to €-32 million in H1 2017. The decrease is mainly linked to higher interest income on deposit, the use of commercial papers at better conditions compared to syndicated loan, and net foreign exchange gain. Total tax charge was €-59 million, representing an effective tax rate of 18.3%.

As a result, net income was € 262 million (4.4% of revenue) up compared to € 239 million in H1 2017, (4.0% of revenue).

Non-controlling interests amounted to € -35 million and were mainly related to the minority shareholders in Worldline. Therefore, the net income Group share reached € 228 million, +7.7% year-on-year.

Both basic EPS Group share and diluted EPS Group share were € 2.16.

Free cash flow

Operating Margin before Depreciation and Amortization (OMDA) was € 721 million representing 12.0% of revenue, compared to € 712 million in H1 2017 (11.9% of revenue).

During the first half of 2018, capital expenditures totaled € 223 million, representing 3.7% of revenue, compared to € 235 million in H1 2017 (3.9% of revenue).

Contribution from change in working capital was negative at €-140 million, compared to €-37 million in H1 2017. The negative change resulted from the very low activity in Mai in Europe this year, making more difficult the invoicing and the collections in June. This also came from a business mix evolution where B&PS business requiring more working capital grew +4% while IDM decreased by -1.7%. Finally the +8.7% growth of Banking and Finance was generated with new customer contracts which are in the phase of ramp-up with longer payment terms.

Total cash-out for reorganization, rationalization, and integration was €-85 million compared to €-101 million in H1 2018, in line with the full year 2017 objective of 1% of Group revenue plus the cost to generate synergies with Equens and SIX Payment acquisition cash.

Cash out related to taxes paid remained low at € 57 million mainly thanks to the use of losses carried forward. Net cost of financial debt paid was €-9 million (€-13 million in H1 2017).

Finally, other items totaled €-28 million, compared to €-20 million in H1 2017.

As a result, the Group free cash flow generated during the first half of 2018 totaled € 180 million, compared to € 242 million in H1 2017.

Net cash evolution

Net acquisitions/disposals in H1 2018 amounted to €-24 million, mainly related to small acquisition performed in 2017.

Capital increase totaled €+13 million compared to €+31 million in the first semester of 2017, mainly reflecting the Group shareholding program SPRINT for employees occurred only in the first half of 2017 and the increase of the number of stock options exercised.

In H1 2018, €-50 million were cashed-out for share buy-back notably to deliver performance shares with no dilution.

The cash-out resulting from the dividend paid on 2017 results was €-70 million. Last year, the option to receive dividend in shares was not granted and therefore led to a cash out of € 168 million.

Finally, foreign exchange rate fluctuation effect on debt or cash in foreign currencies totaled €-5 million compared to €-72 million in H1 2017. In H1 last year, the net cash was significantly impacted by the exchange rate of the US Dollar against Euro.

As a result, Group net cash position as of June 30, 2018 was € 351 million, compared to € 307 million on December 31, 2017.

Human resources

The total headcount of the Group was 96,103 at the end of June 2018 slightly reduced compared to 97,267 at the end of December 2017. The scope impact was related to the acquisition of CVC impacting mainly in Central and Eastern Europe, and to a lesser extent Germany and North America. Excluding scope effect, the staff decreased by -2.0% accompanying and anticipating the effect from automation and robotization mainly in Infrastructure & Data Management and in Business & Platform Solutions.

2018 objectives

The Group confirms all its objectives for 2018 stated in the February 21, 2018 release:

- Revenue organic growth: +2% to +3%.

- Operating margin: 10.5% to 11% of revenue.

- Free cash flow: circa 60% of operating margin.

Syntel acquisition

Atos announced today its agreement with Syntel (NASDAQ:SYNT), a leading global provider of integrated information technology and knowledge process services, with respect to the acquisition by Atos of Syntel, for aggregate consideration of $3.4 billion or $41.0 per Syntel share. Syntel brings to Atos a powerful suite of digital and proprietary solutions recognized by top analysts as being among the most advanced: cloud, social media, mobile, analytics, IoT, and automation at c. 40% of Syntel’s revenue. Syntel will significantly strengthen the Group’s Business & Platform Solutions Division with best-in-class delivery platform generating among the highest margins of the industry. This transaction expands Atos’ capabilities in North America to provide end-to-end services to US customers. It also strongly reinforces its Banking, Finance & Insurance verticals. The compelling match between the two companies offers multiple opportunities for revenue synergies, expected to reach c. $250 million by the end of 2021 with c. $50 million operating margin, through cross-selling opportunities on both European and US customer base. Annual cost synergies are expected by the end of 2021 at c. $ 120 million from G&A optimization taking advantage of the combined scale as well as the alignment of KPIs in Business & Platform Solutions.

This acquisition is expected to be double digit accretive to Group EPS as early as 2019 as well as with a strong double digit EPS accretion with full run rate synergies after 3 years.

This is a major step for Atos, fully supported by Syntel management. Mr Khanna Rakesh CEO of Syntel will become Atos Executive Committee member. Both companies’ Boards of Directors have unanimously approved the transaction. Written voting agreements with Syntel shareholders, including founders, to vote in favor of the transaction represent 51% of the outstanding shares.

The transaction is planned to close by year-end.

The transaction is subject to customary antitrust and regulatory approvals. Applicable works council procedures will be followed.

Appendix

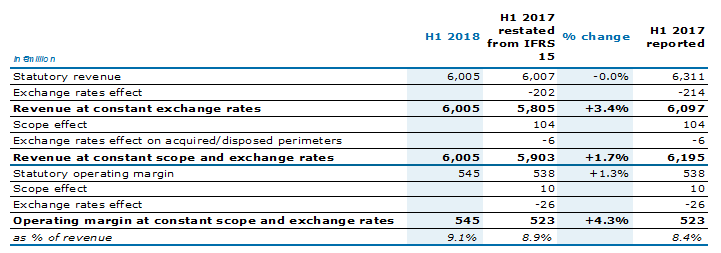

Revenue and operating margin at constant scope and exchange rates reconciliation

IFRS 15 adjustment represented a restatement of H1 2017 accounts of €-303 million for revenue.

Scope effects amounted to €+104 million for revenue. This was mostly related to the acquisitions of CVC, Pursuit Healthcare Advisors, Conduent’s Healthcare Provider Consulting, and Conduent’s Breakaway Group, First Data Baltics, DRWP, MRL Posnet, Imakumo, on one side, and to the disposal of Cheque Service and Paysquare Belgium on the other side.

Exchange rates negatively contributed to revenue for a total of €-208 million, mainly coming from the American dollar and to a lesser extent from the British pound and several South American currencies depreciating versus Euro.

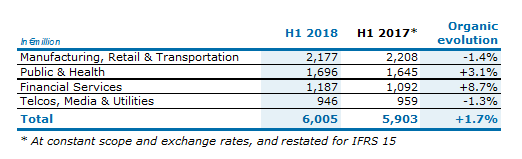

H1 2018 revenue performance by Market

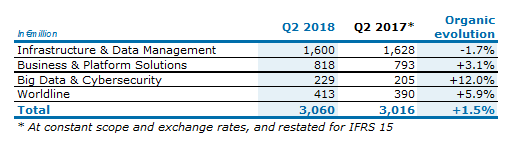

Q2 2018 revenue performance by Division

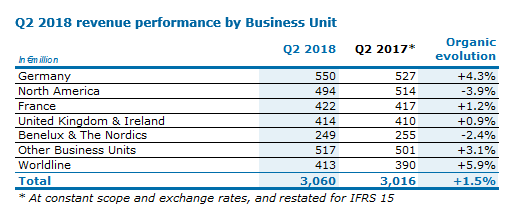

Q2 2018 revenue performance by Business Unit

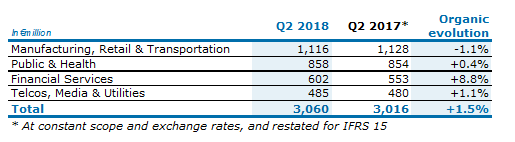

Q2 2018 revenue performance by Market

Conference call

Today, Monday July 23, 2018, The Group will hold a conference call in English at 08:00 am (CET – Paris), chaired by Thierry Breton, Chairman and CEO, in order to comment on the project to acquire Syntel and Atos’ first half 2018 results and answer questions from the financial community.

You can join the webcast of the conference:

- on net, in the Investors section

- by smartphones or tablets through the scan of:

- by telephone with the dial-in, 5-10 minutes prior the starting time:

- France +33 1 76 77 22 57 code 1837029

- UK +44 330 336 9411 code 1837029

- US +1 929 477 0448 code 1837029

After the conference, a replay of the webcast will be available on atos.net, in the Investors section.

Forthcoming events

October 23, 2018 Third quarter 2018 revenue

February 21, 2019 Full Year 2018 results

April 25, 2019 First quarter 2019 revenue

Contacts

Media: Terence Zakka +33 1 73 26 40 76

Investor Relations: Gilles Arditti +33 1 73 26 00 66

***

About Atos

Atos is a global leader in digital transformation with approximately 100,000 employees in 73 countries and annual revenue of around € 12 billion. European number one in Big Data, Cybersecurity, High Performance Computing and Digital Workplace, the Group provides Cloud services, Infrastructure & Data Management, Business & Platform solutions, as well as transactional services through Worldline, the European leader in the payment industry. With its cutting-edge technologies, digital expertise and industry knowledge, Atos supports the digital transformation of its clients across various business sectors: Defense, Financial Services, Health, Manufacturing, Media, Energy & Utilities, Public sector, Retail, Telecommunications and Transportation. The Group is the Worldwide Information Technology Partner for the Olympic & Paralympic Games and operates under the brands Atos, Atos Consulting, Atos Worldgrid, Bull, Canopy, Unify and Worldline. Atos SE (Societas Europaea) is listed on the CAC40 Paris stock index. www.atos.net – Follow us on @Atos

Disclaimers

This document contains forward-looking statements that involve risks and uncertainties, including references, concerning the Group’s expected growth and profitability in the future which may significantly impact the expected performance indicated in the forward-looking statements. These risks and uncertainties are linked to factors out of the control of the Company and not precisely estimated, such as market conditions or competitors behaviors. Any forward-looking statements made in this document are statements about Atos’ beliefs and expectations and should be evaluated as such. Forward-looking statements include statements that may relate to Atos’ plans, objectives, strategies, goals, future events, future revenues or synergies, or performance, and other information that is not historical information. Actual events or results may differ from those described in this document due to a number of risks and uncertainties that are described within the 2017 Registration Document filed with the Autorité des Marchés Financiers (AMF) on February 26, 2018 under the registration number: D.18-0074. Atos does not undertake, and specifically disclaims, any obligation or responsibility to update or amend any of the information above except as otherwise required by law. This document does not contain or constitute an offer of Atos’ shares for sale or an invitation or inducement to invest in Atos’ shares in France, the United States of America or any other jurisdiction.

Revenue organic growth is presented at constant scope and exchange rates and restated for the impact of IFRS 15. Operating margin is presented excluding the amortization of equity based compensation plans and free cash flow is presented excluding proceeds from equity based compensation. Starting January 1, 2018, dividends paid to non-controlling interests are not anymore a Free Cash Flow item but reported in line ‘Dividends paid’.

Business Units include Germany, North America (USA, Canada, and Mexico), France, United Kingdom & Ireland, Worldline, Benelux & The Nordics (Belgium, Denmark, Estonia, Finland, Lithuania, Luxembourg, The Netherlands, Poland, Russia, and Sweden), and Other Business Units including Central & Eastern Europe (Austria, Bulgaria, Croatia, Czech Republic, Greece, Hungary, Israel, Italy, Romania, Serbia, Slovakia and Switzerland), Iberia (Spain and Portugal), Asia-Pacific (Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, Taiwan, and Thailand), South America (Argentina, Brazil, Colombia, and Uruguay), Middle East & Africa (Algeria, Benin, Burkina Faso, Egypt, Gabon, Ivory Coast, Kingdom of Saudi Arabia, Lebanon, Madagascar, Mali, Mauritius, Morocco, Qatar, Senegal, South Africa, Tunisia, Turkey and UAE), Major Events, Global Cloud hub, and Global Delivery Centers.