Atos Financial Services Sandbox: your route to joint value creation

![]()

Market leaders do not stand still, they stand out. In looking for ways to ‘wow’ their customers, financial services institutions do not just want to visualize new services. They want to experience them. The cloud-based Atos Financial Services Sandbox provides the development and demonstration platform to present these experiences and drive new revenue streams.

FinTech ecosystem

Atos Financial Services Sandbox brings together organizations that are committed to investing in a joint go-to-market proposition. We provide the cloud resources, technical templates and integration expertise to align you and your partners.

Show and tell

Atos Financial Services Sandbox shows potential clients what is possible through clear customer journeys. Led by FinTechs, this process allows clients to see how a service works, where it works and the benefits.

FinTech bundling and technology mashups

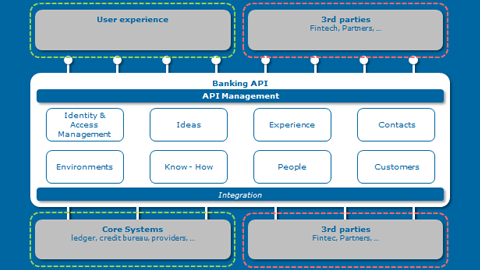

We provide you and your partners with an API platform for DevOps, technology mashups and continuous integration. Access to Atos Financial Services Sandbox is via a single hybrid cloud – available anytime and anywhere.

Go-to-market acceleration

Atos Financial Services Sandbox cloud blueprints will speed up your Proof of Concept – offering rapid reach to the right market. In some cases you may lead StratHacks and work directly alongside the client.

Working with us: Atos Financial Services Sandbox benefits

![]()

With Atos Financial Services Sandbox, our goal is to facilitate joint go-to-market propositions between your organization and a select group of FinTechs.

We provide the resources that encourage your teams to co-create new services via technology mashups or service bundling. In fact, we provide everything you need to get started in a matter of days:

- Access to our FinHub community so you can partner with the right FinTechs

- A cloud-based API platform, available anywhere at anytime

- Technical blueprints, cloud frameworks and networking events

- Integration of new FinTech propositions into your service environment

- Legal, partnership and sales frameworks to define your relationships

- Consulting advice on go-to-market, delivery and replication strategies

- Customer-specific labs with joint investment between Atos and your organization to accelerate working with FinTechs.

The result is a faster route to new revenues and a way to ‘wow’ your customers as expectations continue to rise.

Success stories

![]()

Since the FinTech phenomenon began, Atos has worked hand-in-hand with these emerging businesses to establish new services for some of the world’s biggest banks and insurers.

Join Atos Financial Services Sandbox

![]()

Looking to partner with FinTechs or established players so you can fast track your revenue growth? You have come to the right place

We will work with FinTechs with the hottest technology, value propositions, open culture and businesses that are ready to take the practical steps to generating new sources of revenue in financial services.

Atos Financial Services Sandbox has already established end to end customer journeys through partner ecosystems, including:

- Personal Financial Management

- Loan Origination

- Instant Payments

There is more to come. If you are a financial services institution or FinTech, become part of it.

Our FinTech experts

![]()

Remco Neuteboom

Global Financial Services, Chief Digital Officer

![]()