Dynamic growth and strategic acquisitions

The Group closed the financial year 2018, with revenue organic growth at 1.2% and an operating margin of 10.3%.

The Group’s performance in 2018 positioned Atos as a global leader in digital transformation, with the Atos Digital Transformation Factory representing 30% of total revenue, up from 23% in the previous year.

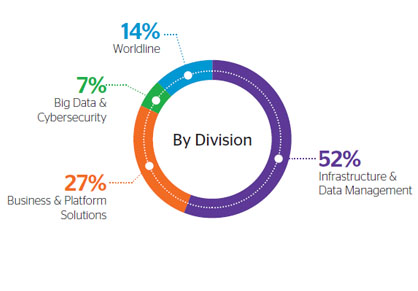

Financial highlights included the acceleration of revenues in our Business & Platform Solutions division, powered by major digital transformation projects. We recorded double-digit growth in Big Data & Cybersecurity as customers around the world stepped up investments in their cyber defenses and data capabilities.

Our Infrastructure & Data Management business saw a strong performance in particular from Orchestrated Hybrid Cloud, with growth of circa 35%.

Atos strengthened its digital services global profile and capabilities with the acquisition of Syntel and enhanced Worldline’s position as the undisputed payment leader in Europe through the acquisition of SIX Payment Services.

Revenue

(1) at constant scope and exchange rates.

Operating margin

(2) restated for IFRS 15

Free Cash Flow

(3) excluding €62 million of acquisition and upfront financing costs related to Syntel and SIX Payment Services acquisitions.

Headcount

2018 statutory figures

Measuring our integrated performance progress

![]()

Atos recognizes that our financial success is intrinsically linked to our progress in corporate responsibility and sustainability. We aim to create sustainable, long-term value for all stakeholders, including our customers, shareholders, employees and society in general. That is why we regularly monitor our financial and extra-financial performance to ensure we are on track to meet our main objectives and challenges.

Finance

| KPI | Organic growth revenue | Operating margin rate | An operating margin conversion rate to free cash flow |

| Advance2021 | +3 to +4% CAGR over the 2019-2021 period | circa 13% of revenue in 2021 | €1.2 to 1.3bn in 2021 |

| Advance 2021* | +2 to +3% CAGR over the 2019-2021 period | 11% to 11.5% of revenue in 2021 | €0.8 to 0.9bn in 2021 |

| 2018 Values | +1.2% organically in 2018 | 10.3% of revenue in 2018 | 57.1% in 2018(1) |

| 2017 Values | +2.3% organically in 2017 | 10.2% of revenue in 2017 | 56.5% in 2017(2) |

| 2016 Values | +1.8% organically in 2016 | 9.4% of revenue in 2016 | 52.5% in 2016 |

* Advance 2021 in Digital Services (Atos excluding Worldline)

People

| KPI | Great Place To Work Trust Index® |

| Advance 2021 | Reflecting employees’ satisfaction to top 10% industry benchmark |

| 2018 Values | 57% in 2018 |

| 2017 Values | 54% in 2017 |

| 2016 Values | 54% in 2016 |

Business & Innovation

| KPI | Net Promoter Score | Digital Transformation Factory Revenue |

| Advance 2021 | 50% + by 2021(3) | |

| 2018 Values | 48% in 2018 (3) | 30% of total revenue in 2018 |

| 2017 Values | 48% in 2017 (4) | 23% of total revenue in 2017 |

| 2016 Values | 48% in 2016 (4) | 13% of total revenue in 2016 |

Ethics & Governance

| KPI | Code of Ethics | Suppliers |

| Advance 2021 | 100%of employees trained on the Code of Ethics | 70%of total spend assessed by supplier sustainability rating agency EcoVadis by 2021 |

| 2018 Values | 92% in 2018 | 55% of total spend |

| 2017 Values | 91% in 2017 | 54% of total spend |

| 2016 Values | 86% in 2016 | 49% of total spend |

Environment

| KPI | Global footprint |

| Advance 2021 | Reduction by 7% to 20% CO2 emissions per revenue unit (tCO2 per €million) by 2021 2016 baseline(5) |

| 2018 Values | 18.2 tCO2 per Million € in 2018 |

| 2017 Values | 19.28 tCO2 per Million € in 2017 |

| 2016 Values | 22.14 tCO2 per Million € in 2016 |

1) excluding €62 million of acquisition and upfront financing costs related to Syntel and SIX Payment Services acquisitions

(2) exluding pension one-off

(3) NPS for all clients

(4) NPS for top clients

(5) at constant scope

Sustainable performance

![]()

Being a responsible employer

Atos has the responsibility and ambition to constantly support a diverse, talented and motivated workforce, and to provide employees with relevant skills for digital transformation.

Generating value for clients through sustainable and innovative solutions

Leveraging a global ecosystem of partners, Atos creates innovative and sustainable solutions to deliver value for clients, while ensuring the highest levels of security and data protection and promoting a culture of digital responsibility.

Being an ethical and fair player within Atos’ sphere of influence

As a global company, Atos is expected to have strong corporate governance and ethical standards shared along the whole value chain.

Supporting the transition to a low-carbon economy

To support our clients in the necessary transition to a low-carbon economy Atos improves the efficiency and resilience of its operations and mitigates the risks arising from natural disasters.